14 Jan The Future of Mortgage Rates and Home Prices

Experts are chiming in on the outlook of how mortgage rates and pricing could change shortly. After a historic year for the mortgage industry and high demand, a positive outlook for 2021 real estate remains. There are many factors to consider, and as Money.com says, expect the unexpected.

Many experts suspect a vaccine can become available to the masses by the spring season, which will help boost economic recovery. As the economy begins to strengthen and as normalized activity hits the market, expect to see borrowing costs and home prices grow. Fortunately, these increases will be more modest and at a much slower pace than experienced in 2020.

Steady Mortgage Rates

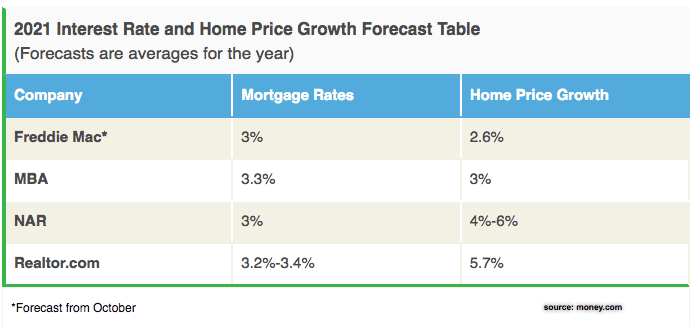

In the first week of the New Year, fixed mortgage rates hit yet another all-time low. The 30-year fixed-rate sank to 2.65 percent, which is more than one percent than a year ago. Freddie Mac reported this is the lowest number rates have been since tracking began in 1971. Forecasts predict the 30-year fixed will move toward a 2.9 percent average in 2021. Throughout the year, we will most likely numbers hovering around the three percent average and rise to 3.4 percent by the end of the year. Looking back at the end of 2019, when the 30-year fixed-rate averaged 3.7 percent, Chief Economist Lawrence Yun says this year will still be historically favorable.

What are the driving forces behind the rise and fall of mortgage rates? One is the Federal Reserve’s intention to keep low rates for the next two or three years as an attempt for the government to support economic recovery and to help with uncertain progress in unemployment and the vaccine. The Fed does not control mortgage rates directly; their actions will still have an impact on rates.

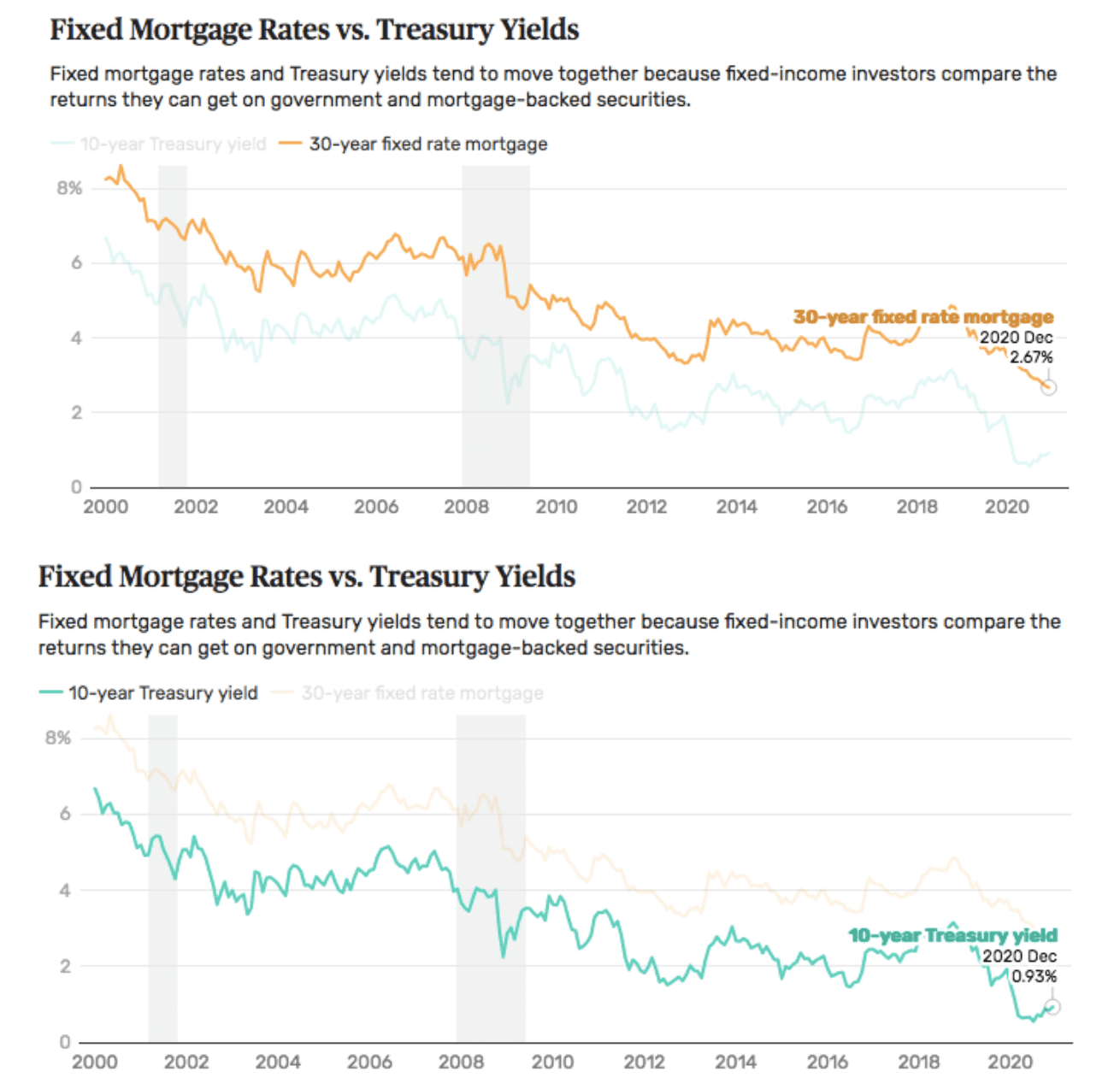

Another is the 10-year Treasury yield. The Treasury yield is the interest rate the government pays to borrow money over different periods. Back in March, when the first pandemic concerns hit the country, the 10-year Treasury yield reached an all-time low of 0.54 percent. Just this month, the yield mark tipped over the one percent line at 1.04 percent – the highest since March 2020. The Treasury rates tend to influence the movement of rates or act as a benchmark for mortgage rates. Therefore, if the 10-year Treasury yield continues to increase, mortgage rates will bump up. See the patterns displayed in the following graphic:

HousingWire’s Data Analyst, Logan Mohtashami, ultimately believes the rise of mortgage rates is contingent on the pace of the economy’s health.

What can these rates do for you?

Real Estate in 2021 continues to be consumer-friendly. Before rates begin to rise mid-year, you may want to lock in a low rate. If you plan to buy a house in the next year or two, you will have a good chance of locking in a great rate. If you are a homeowner, you may want to consider refinancing. Industry professionals suggest doing it sooner rather than later. Make sure to reach out to our office or your mortgage lender for an estimate to make sure you get the best deal possible.

Home Prices Going Up

Rising home prices have been a trend for years, and we saw no difference in 2020. Freddie Mac reported that by the end of October 2019, home prices rose to 20 percent annually. Realtor.com’s housing report showed an increase of 12.7 percent annually for November. Home price predictions between industry professionals vary. The good news is that any price increase will not be as dramatic as 2020. And depending on how rates move, it could create a new effect on mortgage payments and affordability.

CoreLogic’s chief economist Frank Nothaft predicts price growth will slow once vaccines reach the general public. Altogether, Nothaft predicts a 2.1% growth rate across the year. Danielle Hale, chief economist at Realtor.com predicts higher appreciation, at 5.7% — though that’s still lower than what we’ve seen in 2020.

“This [price growth] is a much more manageable pace of increase than recent double-digit percent gains,” Danielle Hale of realtor.com said. “But mortgage rates that are steady or rising won’t provide the same offset that they did in 2020, so monthly mortgage payments will rise and be challenging in a way that they haven’t been in 2020.”

If interest rates continue to rise, first-time homebuyers may be pushed outside the market, as affordability may be more of a challenge. Especially within the first half of the year, unemployment persists, and wage growth falls behind the increase in home prices and lack of supply.

For home prices to drop or stabilize, inventory will have to make significant progress. Even though sales numbers were up, both existing and new home supply reached an all-time low. The industry expects more new and existing homes to become available as the year progresses. Builder confidence is in a positive state, and housing starts were at a 1.5 million seasonally adjusted annual rate back in November. Homeowners who held off during the pandemic will begin listing their homes, which adds to the total available inventory.

Once again, inventory gain can help ground home prices, but the industry will continue to face the affordability factor depending on the economy and unemployment status. The housing sector has shown resilience repeatedly this past year. Though there may still be risk and uncertainty with 2021, the industry stands on a solid foundation. Stay informed, talk with your real estate and mortgage professionals, and reach out with any questions. If you plan to buy, sell, or refinance this year, we want to help you get there.

This article is intended to be accurate, but the information is not guaranteed. Please reach out to us directly if you have any specific real estate or mortgage questions or would like help from a local professional. The article was written by Sparkling Marketing, Inc. with information from resources like MSN, Forbes, Money.com, Realtor.com

Sorry, the comment form is closed at this time.