20 May How Much House Can You Really Afford?

Buyers are experiencing the most heated competition in real estate in almost ten years. If you are planning to enter the market, it is a must – not an option – to be prepared for the bidding wars you’ll encounter. A popular question is “how much can I afford when buying a house?” Well, it all depends. With the daily changes in mortgage rates, an increase in home prices, available homes, and your budget to consider, it may be hard to tell. Let’s break it down so you are clear, on budget, and know what to expect.

Headlines continue to push the decreasing inventory of homes for sale nationally. It hit a record low of 1.03 million units by the end of February this year, or about 30% below what it was a year earlier, according to the National Association of Realtors (NAR). That amounts to a two-month supply. In a regular market, economists say a six-month supply is needed for a healthy, balanced market.

Inventory is still crushingly low, but because the demand is so high, home prices have increased. NAR reported that the national median sale price of a single-family home climbed nearly 15% to $315,900 at the end of last year. KTLA mentions the challenges for first-time buyers compared to current homeowners.

“The hurdles to homeownership remain highest for first-time buyers who don’t have profits from a prior home sale to compete in bidding wars. Their inability to find an affordable home is likely to widen the financial gulf between perennial renters and homeowners, who have reaped a windfall in equity gains over the past decade.”

If you are currently a renting or a first-time homebuyer, buying a home is still cheaper than renting in most parts of the country. According to a 2021 Rental Affordability Report by ATTOM, the cost of renting has been high compared to ownership.

“Owning a median-priced three-bedroom home is more affordable than renting a three-bedroom property in 572, or 63 percent of the 915 U.S. counties analyzed for the report. That has happened even though median home prices have increased more than average rents over the past year in 83 percent of those counties and have risen more than wages in almost two-thirds of the nation.”

Realtor.com, explains buyers leverage when making the decision to buy instead of rent:

“For first-time buyers, especially, the drop in the 30-year mortgage rate…has provided unexpected leverage. Lower rates allowed many buyers to stretch and buy more expensive homes while keeping their monthly budget the same.”

For existing homeowners, home values continue to rise, keeping their homes off the market. Zillow put out a survey in Q4 2020 and found that the average home appreciated by more than $20,000 last year. At the beginning of 2021, they conducted another survey with economists and real estate agents predicting that the average home’s value will go up 6.2 to 8 percent this year. Experts hope this information, along with economic relief closing in; more sellers will enter the market.

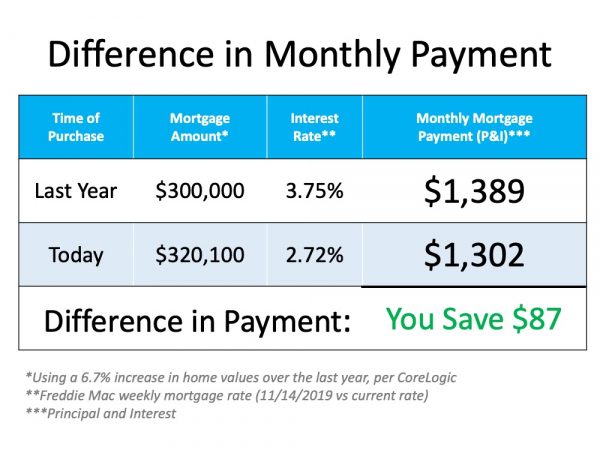

Experts are reminding buyers of the top three factors to consider when budgeting: Home price, Mortgage rates, Cost. The overall cost to buy a home is different than the price of a home and is what determines affordability. Consider the difference in mortgage rates compared to 2019. Your monthly mortgage payment will change depending on the rates saving you thousands of dollars in the long run. Take the example chart below. Saving $87 a month equals $1,044 a year and $31,320 over the course of a 30-year fixed mortgage rate loan.

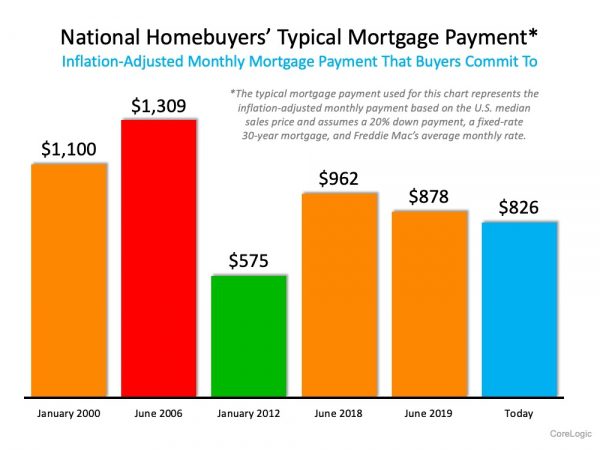

Here is a visual displaying the typical mortgage payment spanning over the last 20 years showing it’s more affordable to buy a home today when you consider all three elements of the affordability equation: price, income, and mortgage rate.

“…even though homes have appreciated by a whopping 6.7% over the last twelve months, the cost to buy a home has actually dropped. This is largely due to mortgage rates falling by a full percentage point.” – CoreLogic

One of the best steps you can take to ensure you can afford the house you want? Get Pre-Approved! Getting Pre-Approved is essential to have as a buyer today. This shows that a lender has reviewed your finances to determine how much you are qualified to purchase. A lender is going to look at your debt-to-income ratio, credit history, assets, and your employment. Not only does a pre-approval give you a clear budget that you can afford, but your offer will also look more desirable to sellers because they know you are a serious buyer. It will give you confidence in your ability to secure a loan, and a competitive edge in a bidding war. In today’s market, getting pre-approved may be the game-changer that helps you secure your dream home.

Knowing your budget, even outside of the most competitive housing market, should be at the top of your buying list. It will narrow down your options when searching for a home saving you time in this fast-paced market. Make sure to reach out to your lender to get pre-approved, and to help make smart financial decisions.

This article is intended to be accurate, but the information is not guaranteed. Please reach out to us directly if you have any specific real estate or mortgage questions or would like help from a local professional. The article was written by Sparkling Marketing, Inc. with information from resources like CoreLogic, NAR, and ATTOM Data Solutions

Sorry, the comment form is closed at this time.