19 Feb Why it’s a Good Idea to Work with Your Lender if you are on a Forbearance Plan

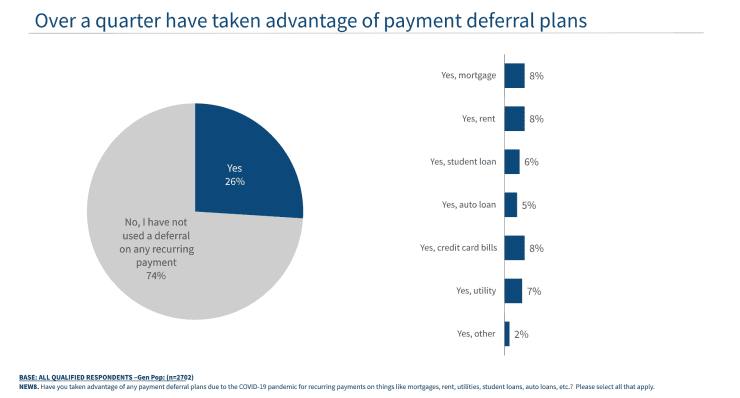

As of September 2020, CNBC reported that 26 percent of Americans took advantage of payment deferment plans. As of late, almost 4 million homeowners have left the home mortgage forbearance program. Forbearance plans helped many households manage during the pandemic. Many Americans are wondering what happens when the forbearance period ends?

Many homeowners who have entered into mortgage forbearance can have temporary relief from payments. New regulations were announced this month. CNBC stated:

President Joe Biden directed federal housing regulators to extend mortgage forbearance programs for an additional six months and prolong foreclosure relief programs on Tuesday in a move that will cover an estimated 70% of mortgages for single-family homes in the U.S.

This allows homeowners to enroll in mortgage payment forbearance programs through June 2021. Regulators also set to extend the ban of foreclosures and forbearance programs for an additional six months for those who already entered a mortgage payment program before June 30, 2020. Bankrate.com’s chief financial analyst claims the extension of federally backed mortgages is critical to preserve homeownership for millions who have been unemployed or financially strapped.

The Mortgage Bank Association (MBA) reported that about 2.7 million homeowners are in a current program, the majority being with private lenders versus federal loans. MBA also notes:

“The share of loans in forbearance decreased at the end of January across all investor categories. Almost 14 percent of homeowners in forbearance were reported as current on their payments at the end of last month, but the share has declined nearly every month from 28 percent in May,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “While new forbearance requests increased slightly at the end of January, the rate of exits picked up somewhat but remained much lower than in recent months. We are anticipating a sharp increase in exits in March and April as borrowers hit the 12-month expiration of their forbearance plans.”

A recent Black Knight Inc. report shows the current homeowner statistics:

• 2,543,000 (39%) are current on their payments and have left the program

• 625,000 (9%) have paid off their mortgages

• 434,000 (7%) have negotiated a repayment plan and have left the program

• 2,254,000 (35%) have extended their original forbearance plan

• 512,000 (8%) are still in their original forbearance plan

• 116,000 (2%) have left the program and are still behind on payments

Your Lender is there to Help

A lender or mortgage professional can help be support and main resource for your financial situation. Suspending monthly payments does not mean forgiveness, so you can work with them on a custom plan. They can help you get back on track with payments and paying back anything owed in the future. Ask what other programs might suit your situation best. Lenders might be able to refinance your mortgage at a lower rate to help lower payments. You may be able to offer other programs that can help with budgeting and debt management.

It’s always best to have a plan before you exit a deferment plan. Start to reevaluate all of your finances and find where you can adjust. A lot is out of your control. Being prepared and knowing what can happen next on your end will save you stress and probably more money.

Whether you are on a payment plan or have gone into forbearance plans, it is important to work closely with your lender so you can keep track and be ahead as the economy changes daily. Everyone has a different situation, and lenders can help you get back on track financially.

This article is intended to be accurate, but the information is not guaranteed. Please reach out to us directly if you have any specific real estate or mortgage questions or would like help from a local professional. The article was written by Sparkling Marketing, Inc. with information from resources like Black Knight Inc, CNBC, MBA, and Freddie Mac.

Sorry, the comment form is closed at this time.